Tax Advantages of Trading Futures

Average Rating 5.00 / 5

1 Reviews

3851

Share :

Tax Advantages of Futures Trading

Well you guys, it’s that time of the year again at Young Money Investments. The bulk of winter weather is behind us and maybe you’re fortunate enough to start planning that summer vacation! It’s also time to start preparing for tax season. As traders, making gains is the name of the game but equally important is keeping your tax bill low! Whether you have filed taxes on trading gains or not, here is a quick guide to the benefits of paying taxes on income gained from trading futures versus stocks and options.

Most experienced traders understand the differences between trading stocks/options versus futures and the benefits each offers depending on the trader’s goals. What very few traders understand though are the tax differences between the two trading avenues. For short-term traders, you may be interested to know that the tax benefits of futures trading are outstanding!

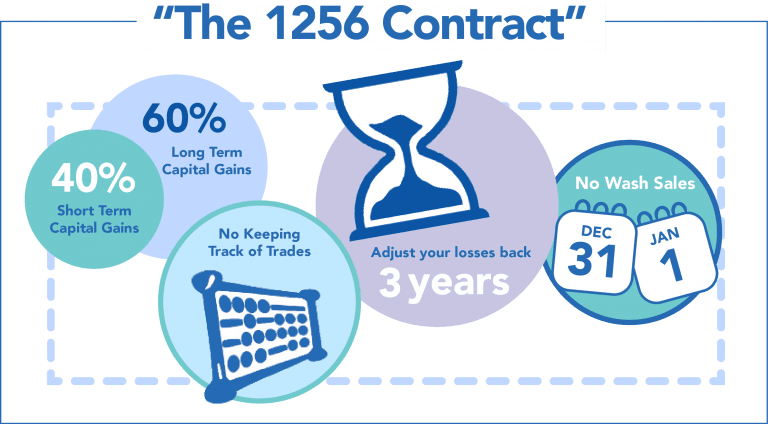

Futures Tax Benefits

So, what are the tax benefits of futures over stocks/options, you ask? While stocks are taxed at the 35% short-term capital gains rate for positions held less than a year, futures are taxed on a 60/40 split. What this means is that 40% of your gains in futures trading is taxed at the same 35% rate as short-term stock trading, while 60% of your gains are taxed at the long-term capital gains rate of only 15%! At the end of the the day, that is a total of 23% (60% x 15% + 40% x 35%) paid in tax versus 35%! To put that into perspective, for every $10,000 earned in any given calendar year, you will pay $1,200 less than an individual who made $10,000 trading stocks and options. If you ask me, this is something that is very important to consider when deciding which markets to allocate your capital to!

To better visualize the tax advantages of futures trading over stock trading consider the following example of Big Money Bob. Big Money Bob enjoys day trading S&P (/ES) futures contracts and Tesla stock. Big Money Bob ends the year with profits equaling $100,000 from his /ES futures contract trading. In addition to Bob’s futures trading, let’s say that Bob also happens to make ANOTHER $100,000 on his Tesla stock! Remember, they call him Big Money Bob for a reason! Come tax season, Bob will be paying $35,000 (35% x $100,000) in taxes on his profits from Tesla stock, while he will only pay $23,000 [$14,000 = ($40,000 x 35%) + $9,000 ($60,000 x 15%)] on his profits resulting from S&P futures trading (/ES). Bob is over the moon that he has retained $12,000 more in profits trading S&P futures because of the way taxes are structured when it comes to short term capital gains tax on futures versus stocks and options!

Other Benefits Of Trading Futures

Futures trading offers many other benefits besides saving on taxes. It’s also important to know that you are not limited to simply trading S&P futures markets, although those are the most liquid out of any other market. Other futures markets include gold (/GC), silver (/SI), oil (/CL), natural gas (/NG) and grains (/ZC). You also have access to other major stock indexes including the Nasdaq (/NQ), and Dow Jones Industrial Average (/YM). The futures markets also allow you to choose your leverage using large contracts for the trader with a higher risk tolerance to the beginner interested in minimizing his/her risk with mini contracts. Futures are also great for new investors who fall under the Pattern Day Trader (PDT) rule because there is no limit to the number of day trades a trader can make in the futures market! Ultimately, the futures markets offer many avenues and benefits that may fit into your financial goals that you are not even aware of.

If you have considered trading futures but are looking for the best mentor to help you reach your goals, check out the Young Money Investments private mentorship on We Trade HQ. You’ll find a great community of like minded traders, detailed instruction on what brokers to use, how to understand new trading language, and what strategies to explore to become the best trader you can possibly be. See you in the chat!

Disclaimer: If you have questions regarding taxes, it is advised that you contact a licensed tax professional. This guide is not intended to be tax advice.There is a substantial risk of loss in futures trading. Past performance is not necessarily indicative of future results. Trade only with risk capital that you can afford to lose and does not affect your livelihood.